In the intricate world of mortgages, the realm of delinquency rates offers a panoramic view of financial stability. Freddie Mac and Fannie Mae, two behemoths in the housing landscape, provide insights into this realm through their serious delinquency rates. As the narrative unfolds, a tapestry of numbers and trends unveils itself, shedding light on the past, present, and future of mortgage health.

Steadfast Decline: Freddie Mac’s Delinquency Numbers

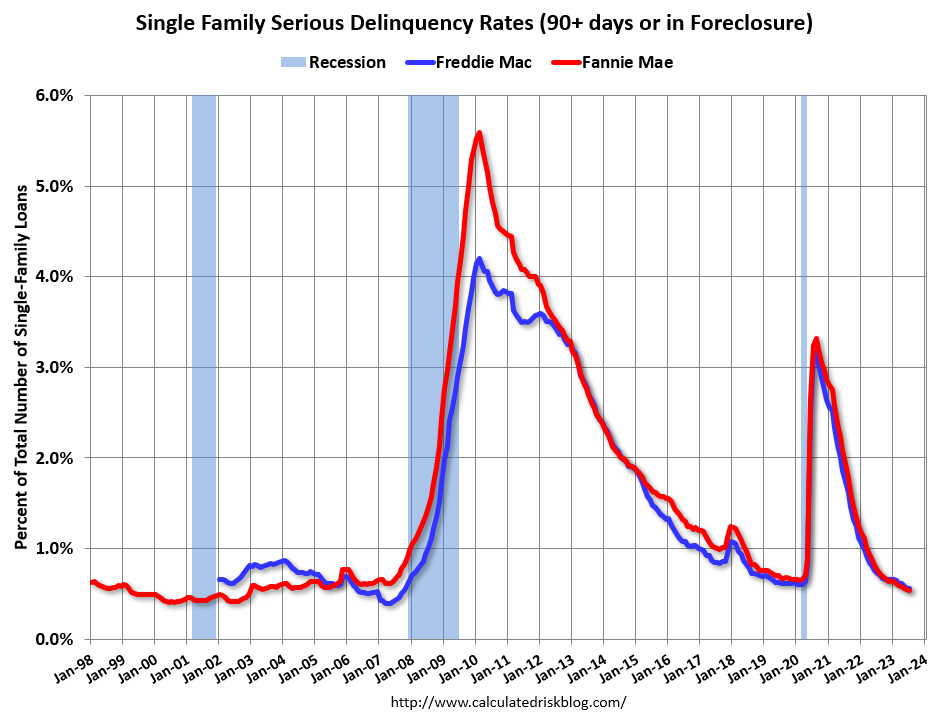

The curtains rise with Freddie Mac’s July serious delinquency rate taking center stage. Unchanged from June, this rate stands at 0.56%. A year-over-year perspective paints a positive picture, with a decline from 0.73% in July 2022. The significance of this figure goes beyond the digits – it treads on hallowed ground, resting below the pre-pandemic low of 0.60%. In a remarkable twist, this rate sits at the lowest point since the days preceding the housing bust.

Navigating Peaks and Valleys: Freddie Mac’s Delinquency Journey

The journey of Freddie Mac’s serious delinquency rate unravels like a narrative of peaks and valleys. The echoes of a past crisis resonate – a peak of 4.20% in February 2010, following the housing bubble, and a peak of 3.17% in August 2020, during the pandemic’s grip. Today, these peaks seem like distant echoes, overshadowed by a resolute decline that defies the tumultuous history.

Fannie Mae’s Delinquency Dive: July Insights

The spotlight shifts to Fannie Mae, with its July Single-Family Serious Delinquency rate taking the stage. A minor dip from June’s rate places it at 0.54%, presenting a decrease. The year-over-year perspective further solidifies the trend, revealing a descent from 0.76% in July 2022. The historical significance gleams through – this rate stands below the pre-pandemic low of 0.65%, marking the lowest point since 2002.

Recalling Peaks: Fannie Mae’s Delinquency History

Fannie Mae’s delinquency history echoes a familiar refrain – the reverberations of historical peaks. The specter of February 2010 looms large, marked by a peak of 5.59% following the housing bubble. August 2020’s pandemic peak of 3.32% adds another layer to this historical tapestry. Amidst these highs and lows, the present rates carve a path that resonates with stability and resilience.

Delinquency Defined: Understanding the Metrics

In the realm of mortgages, the term “serious delinquency” weaves a web of metrics. This classification encapsulates mortgages “three monthly payments or more past due or in foreclosure.” The intricacies of this classification hold significant implications, shaping the narrative of mortgage health and stability.

Forbearance Dynamics: A Nuanced Perspective

The narrative takes a nuanced turn with the inclusion of forbearance-related delinquencies. This addition poses a subtle shift in perspective – while these delinquencies are counted in monthly reports, they don’t find their way to credit bureaus. This distinction paints a layered picture of mortgage health, weaving the intricacies of temporary financial relief into the tale.

Vintage Insights: Fannie Mae’s Loan Analysis

As the spotlight turns to Fannie Mae’s loan portfolio, the stage is shared by vintages. Loans crafted in different epochs unfold their stories, revealing delinquency rates with varying hues. For loans originating in 2004 or earlier, the serious delinquency rate stands at 1.78%, a marginal drop from June. The narrative remains consistent for loans crafted in the years 2005 through 2008, with a rate of 2.82%. The tale takes an unchanged turn for recent loans, spanning the years 2009 through 2023, holding steady at 0.45%. This narrative spotlights a handful of underperforming loans from a bygone era, as Fannie Mae’s portfolio marches towards equilibrium.

The Current Landscape: Steadfast Lending Standards

The prevailing landscape stands as a testament to the impact of steadfast lending standards. With stringent criteria guiding the mortgage journey, the scene is set for a scenario where most homeowners boast substantial equity. This dual force of solid lending standards and homeowner equity converges to shape a narrative that rejects the idea of a colossal wave of single-family foreclosures.

Anticipating the Future: Foreclosure Forecasts

As the tapestry of delinquency rates unravels, projections about the future come to the fore. The echoes of past crises offer a backdrop against which the present can be understood. Amidst this juxtaposition, a distinct conclusion emerges – the present landscape, fortified by resolute lending standards and stable homeowner equity, points towards a future devoid of cascading price declines. The shadows of the past remain just that – shadows, unable to eclipse the resilience of the present.

*Information was pulled from www.calculatedriskblog.com

0 Comments