In an era of skyrocketing costs spanning from groceries to fuel, a pervasive concern looms – the ability of individuals to sustain their mortgage payments. This worry stems from the fear that the escalating financial burden might pave the way for a wave of foreclosures. However, while this notion might stir unease, a closer inspection reveals a different narrative. As the housing market watches closely for any signs of distress, expert insights and data-driven analysis point towards a distinct reality – the impending surge in foreclosures remains improbable.

Speculation Amidst Soaring Costs

Amidst the backdrop of surging living expenses, a palpable anxiety surrounding mortgage affordability takes center stage. The symbiotic relationship between escalating costs and apprehensions of homeowners’ ability to meet mortgage commitments fuels discussions about a looming foreclosure catastrophe. The entwined nature of these concerns raises a fundamental question: Is the present climate a harbinger of an impending foreclosure flood?

Expert Insights: Bill McBride’s Perspective

Bill McBride, a luminary in housing market analysis, stands as a testament to the power of astute observation. Drawing from his ability to foresee the 2008 foreclosure crisis, McBride now turns his analytical gaze towards the current horizon. His assertion that a foreclosure crisis is unlikely resonates as a beacon of insight, but to grasp the basis of this assertion, a deeper exploration is warranted.

Analyzing the Unlikeliness of a Foreclosure Flood

The idea of a foreclosure flood hinges on the premise that a significant portion of homeowners will be unable to fulfill their mortgage obligations. However, a critical factor undermines this narrative: the diminishing number of homeowners grappling with severe delinquencies. Unlike the circumstances that culminated in the 2008 crash, the current landscape portrays a distinctly different picture.

Past vs. Present: Lessons from the Housing Crash

As history offers a canvas for understanding, the 2008 housing crash remains a focal point of analysis. The crux of the crisis lay in the relaxed lending standards that facilitated a surge in mortgages. This leniency, albeit short-sighted, opened the door to an unprecedented wave of foreclosures. However, the lessons learned from that tumultuous period have forged a path towards more stringent lending criteria.

Tightened Lending Standards: A Shield Against Foreclosures

The evolution of lending standards stands as a bulwark against the replication of past mistakes. With greater vigilance in assessing credit scores, income stability, employment status, and debt-to-income ratios, today’s market presents a landscape characterized by qualified buyers. The impact of these stricter criteria extends beyond initial approval – they serve as a safeguard against a recurrence of mass foreclosures.

Declining Delinquencies: A Positive Indicator

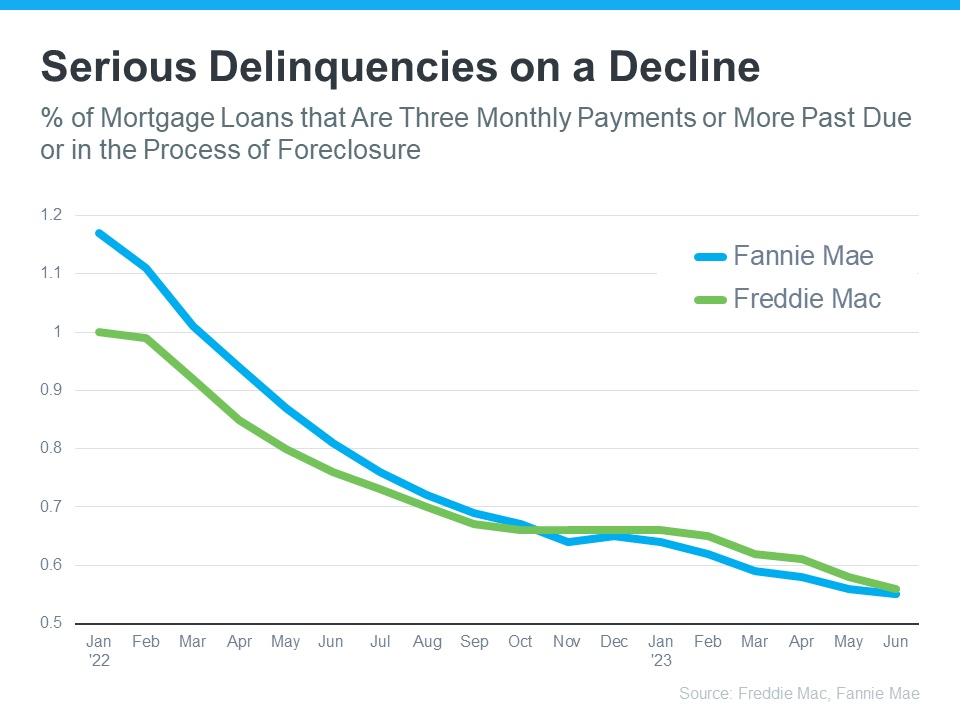

The testament to the shift lies in data from trusted institutions like Freddie Mac and Fannie Mae. This data paints a promising picture – a decline in mortgage delinquency rates. Molly Boese, Principal Economist at CoreLogic, echoes this sentiment, highlighting the significant reduction in serious delinquencies. The trajectory of these rates speaks volumes, mirroring a more resilient and stable landscape.

Understanding Mortgage Delinquency Rates

The notion of mortgage delinquency rates might seem elusive to some. At its core, these rates encapsulate the proportion of homeowners facing payment challenges. Visualizing this data elucidates a striking decline, reinforcing the notion that a majority of homeowners are successfully managing their mortgage commitments.

A Need for a Surge in Mortgage Defaults

To conceive of a foreclosure surge, the foundation necessitates a notable surge in mortgage defaults. This premise, however, stands at odds with the present reality. The diligent payment patterns exhibited by the current generation of homeowners form a formidable barrier against the emergence of a foreclosure wave.

Affordability: The Cornerstone of Foreclosure Risk

At the heart of foreclosure risk lies the concept of affordability – the delicate equilibrium between income and expenses. A homeowner’s ability to comfortably meet mortgage payments pivots on this balance. With diligent payment habits observed in the present, the preconditions for a foreclosure flood remain conspicuously absent.

Present vs. Past Payment Trends

Comparing payment trends of the past with the present draws a stark contrast. The relaxed lending standards of yesteryears paved the way for financial instability. Conversely, the stringent criteria of today act as a counterforce, ensuring that homeowners possess the financial capacity to navigate their mortgage obligations.

Navigating Economic Uncertainties

While the present may hold promise, the undercurrent of economic uncertainties remains. Fluctuations in economic conditions possess the potential to influence payment patterns. Navigating this dynamic terrain requires an awareness of the interplay between financial stability and broader economic dynamics.

Dispelling Misconceptions: Looking Beyond the Hype

In a media landscape marked by sensationalism, it’s essential to temper narratives with nuanced analysis. Rather than succumbing to the allure of alarming headlines, a prudent approach involves heeding the insights of experts and scrutinizing data-driven evaluations. Only through such discernment can a comprehensive understanding of the foreclosure narrative emerge.

Final Word: A Reassuring Outlook

As the discourse on foreclosures unfolds, the pillars of a foreclosure flood’s improbability stand tall. The alignment of tightened lending standards, declining delinquency rates, and robust payment habits erect a barrier against the storm of the past. Amidst the turbulence of economic uncertainty, the housing market holds its ground, guided by the lessons of history and the wisdom of experts.

0 Comments